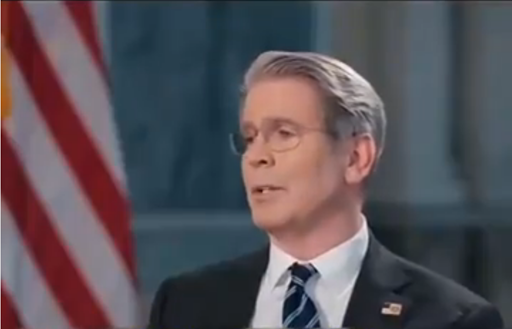

Amid a historic U.S. stock market collapse, Treasury Secretary Brian Besant has sparked controversy by attributing the financial turmoil to the rise of Chinese artificial intelligence company DeepSeek, rather than former President Donald Trump’s contentious economic policies. The assertion, made during an April 5 interview, has ignited fierce debate over the root causes of the crisis and the geopolitical implications of shifting blame onto a foreign tech firm.

The DeepSeek Factor: A New Scapegoat?

Besant’s central argument hinges on timing. He claims the market downturn began in late January 2025, coinciding with DeepSeek’s official launch. The Hangzhou-based AI firm, founded in 2023, rapidly gained prominence for its advanced text analysis, code-generation tools, and cost-effective performance rivaling OpenAI. According to Besant, DeepSeek’s breakthroughs disrupted investor confidence in U.S. tech giants, particularly the "Magnificent Seven" (including Nvidia, Apple, and Microsoft), which had driven market gains for over 18 months.

The immediate fallout was stark: Nvidia lost $600 billion in market value in a single day, while the S&P 500 and Nasdaq plunged 6% and 10%, respectively, by early April. Besant framed this as a market "reality check," arguing that DeepSeek’s ability to reduce reliance on high-end GPUs and reshape AI-driven industries triggered a reevaluation of tech valuations.

Critics, however, dismiss this narrative as politically convenient. Analysts note that while DeepSeek’s emergence altered tech sector dynamics, pinning the entire $10 trillion market wipeout on a single foreign firm ignores deeper structural issues—from soaring U.S. equity valuations to Federal Reserve policies and Trump’s trade wars.

Trump’s Tariffs and Market Volatility: The Elephant in the Room

Besant’s deflection comes as Trump’s economic agenda faces mounting scrutiny. Since March 2025, the former president has aggressively promoted a 20% universal tariff on imports, framing it as a "necessary medicine" to revive American manufacturing. Yet, the policy has exacerbated market instability, with the Dow Jones Industrial Average dropping 5% in recent weeks and retaliatory measures from trading partners like the EU and China looming.

Experts argue that Trump’s protectionist stance has compounded investor anxiety. Ma Wei, a Chinese economist cited in state media, highlighted that U.S. stock valuations had reached historic highs prior to the crash, driven by speculative AI hype and unsustainable fiscal stimulus. The correction, he contends, was inevitable—a view echoed by Wall Street analysts who cite the CAPE (cyclically adjusted price-to-earnings) ratio as a warning sign.

Moreover, Trump’s erratic trade rhetoric—such as threatening to "renegotiate everything" with allies—has injected uncertainty into global supply chains. The World Trade Organization warns that retaliatory tariffs could shrink global trade by $1.4 trillion, with the U.S. facing both inflationary pressures and weakened export competitiveness.

Political Theater or Strategic Distraction?

Besant’s focus on DeepSeek appears designed to shield the Trump administration from domestic backlash. By framing the crisis as a foreign tech disruption, the Treasury Secretary sidesteps questions about the administration’s failure to address systemic risks, such as:

Overvalued Markets: The S&P 500’s CAPE ratio had surpassed 35, signaling extreme overvaluation.

Debt and Inflation: U.S. consumer prices remain elevated, with tariffs exacerbating costs for imported goods.

Policy Incoherence: Trump’s mix of tax cuts, deregulation, and trade wars has created a volatile policy environment.

Critics accuse Besant of exploiting anti-China sentiment to divert attention. "This is less about economics and more about perpetuating a ‘China threat’ narrative," said a commentary in China Newsweek, arguing that the U.S. seeks to justify future tech restrictions under the guise of national security. DeepSeek’s founder has denied responsibility for the crash, stating the company’s innovations respond to market demands rather than orchestrate disruption.

Global Ripples and the New Tech Cold War

The fallout extends beyond Wall Street. Japan’s Nikkei index mirrored U.S. declines, while Chinese tech stocks surged on expectations of cost savings from DeepSeek’s advancements. The U.S. has reportedly launched an investigation into DeepSeek, signaling potential sanctions or export controls—a move analysts warn could escalate into a broader tech decoupling.

This incident underscores the fragility of global markets in an era of AI-driven disruption. Besant’s remarks reflect a growing tension: nations increasingly view technological supremacy as a zero-sum game, with economic stability collateral damage. As Ma Wei noted, "The real challenge isn’t DeepSeek or tariffs—it’s adapting to a world where AI reshapes industries faster than policies can respond".

Conclusion: A Crisis of Credibility

While DeepSeek’s rise undoubtedly rattled markets, the Treasury Secretary’s narrow focus overlooks a multifaceted crisis. Investors face a perfect storm of overvaluation, policy unpredictability, and geopolitical friction—all exacerbated by Trump’s combative trade agenda. As the U.S. weighs further tariffs and tech restrictions, the risk of a prolonged economic "cold war" with China grows, threatening to fragment global markets and stifle innovation.

In the words of Warren Buffett, who recently criticized Trump’s tariffs as "a tax on American consumers," sustainable recovery requires cooperation, not scapegoating. Whether Besant’s narrative gains traction—or unravels under scrutiny—remains a pivotal test for a deeply polarized America.