As of 2025, Facebook remains a dominant force in the global social media landscape, with over 3 billion monthly active users (MAUs) worldwide . However, its trajectory in the U.S. market is undergoing significant shifts, driven by changing user demographics, competition from younger platforms, and evolving content consumption habits. This article explores Facebook’s user base in 2025, its standing among the top social media platforms in the U.S., and the factors shaping its future.

Total Users: Facebook is projected to have 246–262 million monthly active users (MAUs) in the U.S. by 2025 . This figure reflects steady but slowing growth, with annual increases of approximately 5% in recent years .

Daily Active Users (DAUs): Around 193 million Americans use Facebook daily, spending an average of 30.9 minutes per day on the platform .

Demographics:

Age: While Facebook remains popular across all age groups, its user base skews older. Adults aged 25–34 are the largest demographic (31.1%), followed by 35–44 (20.2%) and 55+ (15.8%) .

Gender: Men make up 56.8% of Facebook’s global user base, but in the U.S., women are slightly more active (76% vs. 59% of men) .

Geography: Rural Americans are more likely to use Facebook (74%) compared to urban (67%) or suburban (70%) users .

Slowing Expansion: Facebook’s U.S. user growth has decelerated from 4.3% in 2021 to 0.6% in 2023, a trend attributed to market saturation and competition from platforms like TikTok and Instagram .

Youth Migration: Teen usage has declined sharply, from 71% in 2016 to 32% in 2024, as younger users flock to platforms like TikTok and Snapchat .

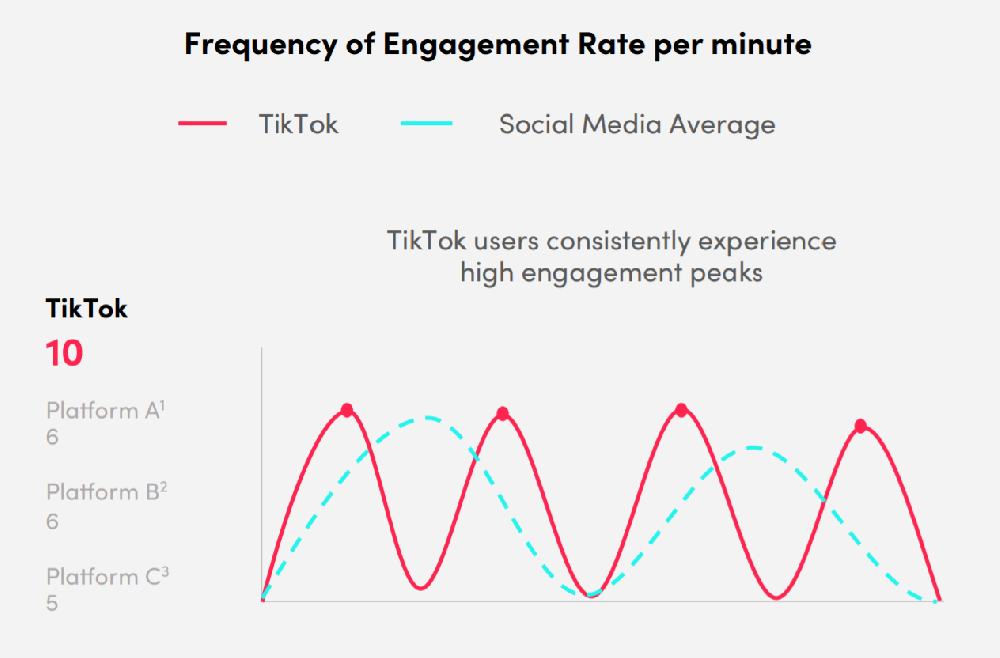

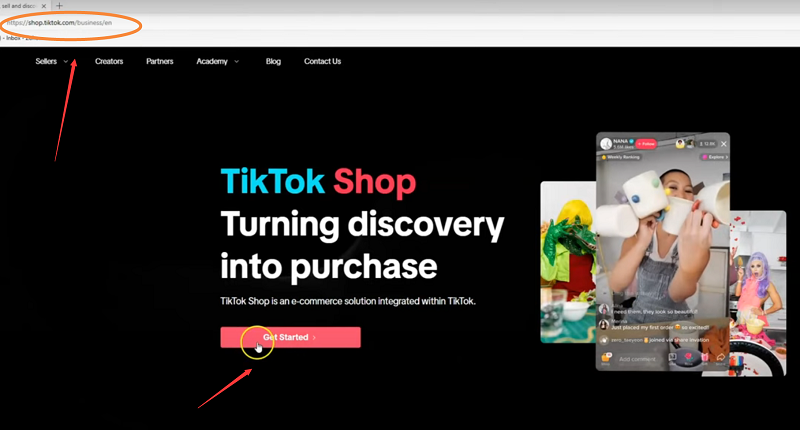

TikTok: With 170 million MAUs in the U.S., TikTok has surged in popularity, particularly among Gen Z and younger millennials. Its short-form video format and algorithm-driven content have made it a cultural phenomenon .

Instagram: Owned by Meta, Instagram boasts 171.7 million MAUs in the U.S., focusing on visual content and influencer marketing. It has successfully retained younger users through features like Reels and Stories .

Facebook: Despite its large user base, Facebook faces intense competition. While it still reaches 68% of U.S. adults, its dominance is eroding, especially among younger demographics .

Youth Engagement: Only 13% of Gen Z users prioritize Facebook, compared to 82% who use TikTok .

Content Preferences: Users under 30 prefer platforms like TikTok for entertainment and news, while Facebook is increasingly seen as a tool for connecting with family and local communities .

Platform Fatigue: Many users cite “information overload” and political polarization as reasons for reduced engagement .

TikTok’s Rise: TikTok’s U.S. user base grew by 20% in 2024, with users spending an average of 53.8 minutes per day on the app—significantly more than Facebook’s 30.9 minutes .

Instagram’s Loyalty: Instagram’s focus on visual storytelling and Reels has helped it retain younger users. Over 76% of 18–29-year-olds use Instagram daily .

Snapchat’s Niche: Snapchat, with 106.7 million U.S. MAUs, appeals to teens and young adults with its ephemeral content and AR filters .

Investment in AI: Meta has prioritized AI-driven features like personalized content recommendations and ad targeting to boost engagement. Over 20% of Facebook’s feed content is now AI-recommended .

Metaverse and VR: While the Metaverse remains in its infancy, investments in virtual reality (VR) could diversify Facebook’s offerings beyond social media .

Monetization Strategies: Facebook Marketplace has grown to 40% of active users, driving e-commerce revenue and retaining older demographics .

Data Privacy Laws: Stricter regulations, such as the EU’s GDPR and U.S. state-level laws, have forced Facebook to adjust its data collection practices, potentially impacting ad targeting effectiveness .

Misinformation and Polarization: Facebook continues to face criticism over misinformation spread and political divisiveness, which could deter advertisers and users .

Stable but Not Dominant: Facebook will likely maintain its position as a top-three platform in the U.S. due to its massive user base, but its growth will remain stagnant.

Niche Audience Retention: Older demographics (Baby Boomers and Gen X) will remain loyal, while younger users will migrate to TikTok and Instagram.

Revenue Growth: Ad revenue is projected to grow to $116.53 billion in 2025, driven by AI and improved targeting .

Irrelevance Among Youth: If Facebook fails to innovate, it could become a “legacy platform” like MySpace, losing relevance among younger generations.

Competition from Emerging Apps: Platforms like BeReal and Threads (Meta’s Twitter competitor) could further fragment the market

In 2025, Facebook will retain its status as a top-three social media platform in the U.S., with a user base of approximately 250–260 million MAUs. However, its dominance is increasingly challenged by TikTok and Instagram, which appeal to younger demographics and offer more engaging content formats. Meta’s ability to innovate, invest in AI, and adapt to regulatory changes will determine whether Facebook can maintain its relevance in the long term. While it may not reclaim its former glory, Facebook’s role in connecting older generations and fostering local communities ensures it will remain a significant player in the social media landscape.