Elon Musk's acquisition of Twitter, now rebranded as X, has been one of the most talked-about business moves of the decade. The $44 billion deal was driven by Musk’s vision to transform the platform, but it also came with significant financial risks. Let’s explore the journey of this acquisition and whether Musk managed to turn it into a profitable venture by 2025.

The Acquisition and Initial Challenges

When Musk purchased Twitter in late 2022, it was facing several challenges. The platform was struggling with revenue generation, user retention, and content moderation issues. Additionally, the acquisition was heavily financed through debt, which put additional pressure on the company’s financial performance.

Key Strategic Moves

To address these challenges, Musk implemented several strategic initiatives:

Rebranding to X: One of Musk’s first moves was to rebrand Twitter to X, reflecting his broader vision for the platform. This rebranding aimed to rejuvenate the platform’s image and attract new users.

Product Innovations: Musk introduced numerous product innovations, including improved content moderation tools, advanced AI-driven recommendations, and new monetization features like subscription services and ad-free experiences.

Cost-Cutting Measures: Significant layoffs and operational streamlining were undertaken to reduce costs and improve efficiency. By cutting down on unnecessary expenses, Musk aimed to stabilize the platform's financial health.

Enhanced User Experience: Emphasizing user engagement, Musk focused on creating a more personalized and enjoyable user experience. New features were added to encourage user interaction and retention, such as enhanced video capabilities and innovative communication tools.

Financial Performance by 2025

Despite these efforts, the road to profitability was not smooth. Here is an overview of X's financial journey from 2022 to 2025:

Revenue Growth

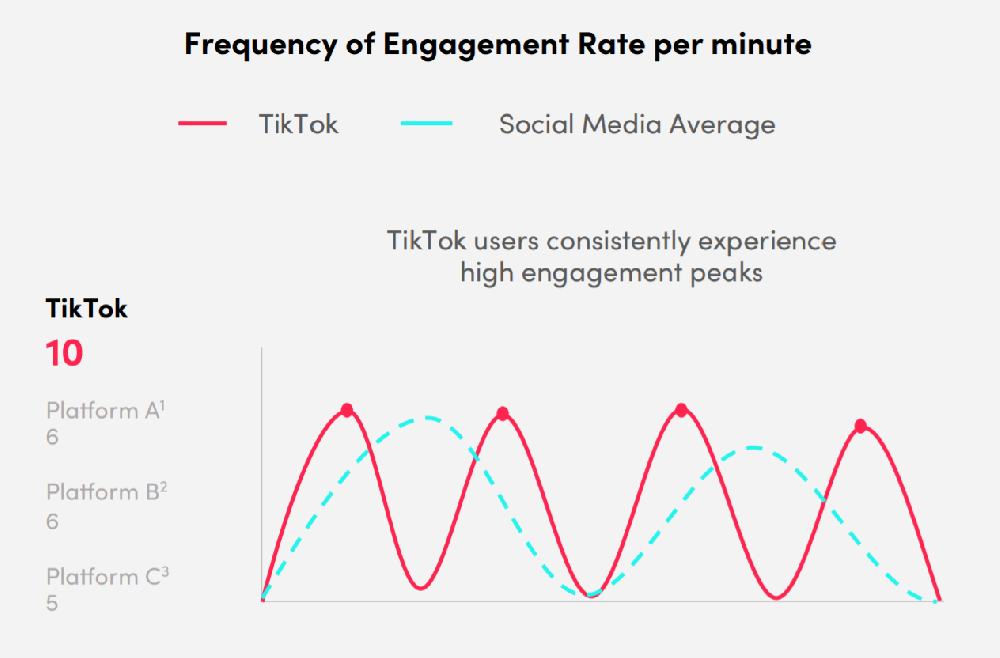

X experienced modest revenue growth, driven by the introduction of new monetization features and the rebranding strategy. However, the growth was not as substantial as Musk had hoped. The advertising revenue remained a significant part of the company’s income, but competition from other platforms like Meta’s Threads and TikTok posed challenges.

Debt and Financial Stability

The massive debt incurred during the acquisition remained a significant burden. The $13 billion in debt financing led to high-interest payments, which impacted the company’s profitability3. Despite efforts to improve financial stability through cost-cutting and revenue generation, the debt load made it difficult for X to achieve substantial profits.

User Base and Engagement

X managed to retain and slightly grow its user base, thanks in part to the rebranding and new features. However, the user growth was not as explosive as expected, and the platform continued to face stiff competition from other social media giants.

Market Valuation

By 2025, X's market valuation had decreased significantly from the $44 billion purchase price. Reports suggest that the valuation dropped to around $19 billion, highlighting the challenges in turning the platform into a financial success3.

Conclusion

As of 2025, Elon Musk’s acquisition of Twitter (now X) has not yielded the expected financial success. Although there were positive developments in user engagement and product innovation, the heavy debt burden and intense competition hindered substantial profitability. However, Musk remains committed to his vision, and with continued efforts, there is potential for X to become a profitable venture in the future.