Two months after TikTok's dramatic re-listing on U.S. app stores on February 14, 2025, the platform's revival has sparked intense debate: Have the so-called "TikTok refugees"—users who migrated to alternative apps during its ban—returned to the platform? A synthesis of user behavior trends, commercial dynamics, and geopolitical developments reveals a nuanced answer.

1. The Ban and Exodus: A Brief Retrospective

TikTok's U.S. operations faced existential threats in early 2025 when a "sell-or-ban" ultimatum temporarily removed it from Apple and Google Play stores. During this 26-day hiatus (January 19–February 14), competitors like Instagram Reels and YouTube Shorts saw surges in downloads as users scrambled for alternatives. Notably, some migrated to Xiaohongshu (Little Red Book), a Chinese lifestyle app, framing their shift as a protest against perceived political overreach. Professor Huang Jing of Shanghai International Studies University described this cohort as "digitally displaced" users leveraging platform loyalty as cultural resistance.

2. The Relaunch Surge: Immediate User Rebound

TikTok's reinstatement triggered a rapid resurgence:

Download volumes doubled compared to pre-ban levels, outpacing competitors whose growth stalled.

700 million U.S. commercial accounts reactivated within weeks, driven by creators like Kiara Springs (monthly earnings: $50,000) and Oluwatoyese (gaming influencer), who faced income loss during the ban.

"Plan B" strategies, including QR-code sideloading for Android users, minimized attrition during the ban, ensuring a smoother transition back.

This rebound suggests many "refugees" prioritized platform familiarity and monetization over ideological alignment with alternatives.

3. Commercial Imperatives: Why Users Came Back

A. Creator Economy Lock-In

TikTok's ecosystem has entrenched dependencies:

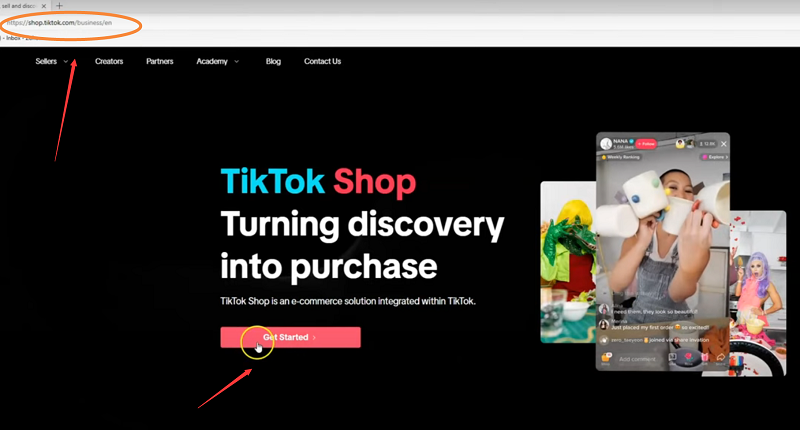

700,000 U.S. businesses rely on TikTok Shop and ad revenue streams.

Content-to-commerce pipelines—like TikTok Shop's seed-and-sell model—offer unmatched monetization efficiency. For example, TikTok's U.S. GMV hit $9 billion in 2024, with live-stream commerce gaining traction despite cultural adaptation challenges.

B. Algorithmic Superiority and User Habituation

TikTok's AI-driven "For You Page" (FYP) creates addictive content loops. Competitors like Instagram Reels lack equivalent personalization depth, leading to higher user churn.

80% of TikTok's 2024 downloads were organic, indicating entrenched user habits that competitors struggled to disrupt.

4. The Lingering Divide: Who Stayed Away?

Not all refugees returned. Two cohorts remain outliers:

Ideological Migrants: A minority of users, particularly those identifying as "TikTok refugees," continue using Xiaohongshu or encrypted platforms like Signal as symbolic resistance .

Niche Content Creators: Vertical communities (e.g., long-form educators) found better alignment on YouTube or Patreon during the ban and have yet to fully reinvest in TikTok.

5. Geopolitical and Strategic Adaptations

TikTok's parent company, ByteDance, has accelerated contingency plans to hedge against future bans:

Southeast Asia Expansion: Redirecting resources to markets like Indonesia and Thailand, where TikTok Shop’s 2024 GMV grew 300% year-on-year.

Cost Control: Slashing marketing budgets and enforcing "revenue-over-spend" principles to mitigate political risks.

These measures aim to stabilize the platform’s global footprint, reassuring users and advertisers of its long-term viability.

While the majority of TikTok refugees have returned, driven by economic necessity and platform loyalty, the ban catalyzed lasting behavioral shifts. Users now exhibit heightened platform diversification, and ByteDance’s strategic pivots underscore the fragility of digital ecosystems in geopolitically charged environments. As TikTok’s U.S. GMV targets $12 billion for 2025, its ability to retain this reclaimed audience will hinge on balancing commercial agility with political resilience.